Asset owners with $8.5trn commit to net zero emissions by 2050

22 asset owners with $1.2 trillion in assets have committed to cut the carbon emissions of their portfolios to net zero by 2050 or sooner as their contribution to decarbonize the global economy.

The commitments were made at the launch of the ‘Net Zero Investment Framework’ by the Institutional Investors Group on Climate Change (IIGCC), designed to help deliver on the goal of the Paris Agreement to keep global warming below 1.5°.

With other investment leaders having already promised to aim for net zero emissions, today’s announcements mean that a total of 37 investors managing $8.5 trillion in assets are meanwhile putting the Framework into practice.

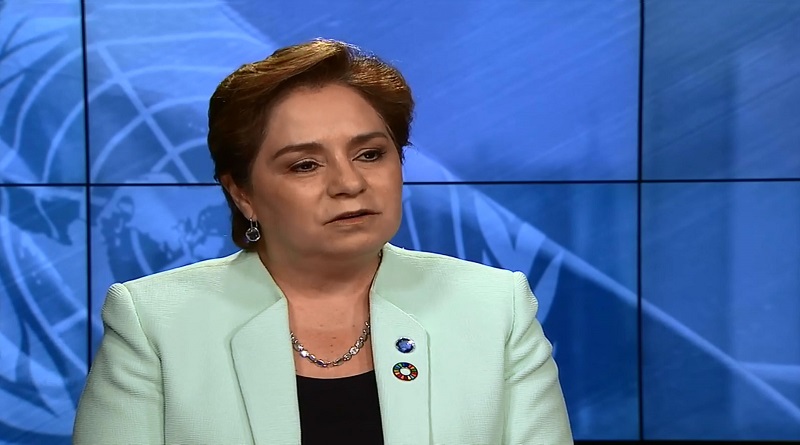

“Investing in a net zero future is key to tackling the climate crisis and unlocking truly sustainable growth. It is actually in the interest of all,” said UN Climate Change Executive Secretary, Patricia Espinosa. “I encourage others to join investors already showing leadership in using the Net Zero Investment Framework. The race to a net zero future is on and the benefits it offers are critically important.”

Increased focus on the climate crisis from clients and governments has forced investors to confront the carbon emissions of the companies that they fund.

Today’s commitments come at a crucial time, with only eight months left before the UK hosts the UN Climate Change Conference COP26 in Glasgow in November.

More investor commitments are expected to follow, helping build momentum in the run-up to COP26. The Framework is also expected to be included in the United Nations Race to Zero Campaign, following the completion of an independent assessment process currently underway.

“The global investment community has been called on to play its part in the transition to net zero – and it is answering that call,” said Stephanie Pfeifer, CEO, Institutional Investors Group on Climate Change. “This new swathe of net zero commitments from asset owners demonstrates the growing determination from investors to make important decisions to support a net zero and resilient future.”

Building on IIGCC’s existing work to date, the finalized Framework is being published in partnership with other investor groups across North America, Asia and Australasia. It will be rolled out globally as the basis for investors worldwide to implement their net zero strategies.